5 Reasons We Favor US Stocks | Weekly Market Commentary | June 22, 2020

Among developed markets, we maintain our preference for US equities over international, but the bout of strong performance for the MSCI EAFE Index relative to the S&P 500 Index in late May through early June and the latest weakness in the US dollar are noteworthy. We share our latest thoughts on international equities and reiterate our positive emerging markets view.

FIVE REASONS FOR CAUTION

We have five reasons for our continued cautious tactical outlook toward developed international equities, most of which are composed of European stocks.

1) Weaker economic outlook. We expect economies in Europe to contract more than the United States or Japan in 2020 due to the pandemic, consistent with Bloomberg’s consensus forecasts. Although Europe has generally done as well or better than the United States in containing the virus, the economic impact of the lockdowns appears to be greater there, and its stimulus jolt has lagged that of the United States and Japan. Bloomberg’s consensus estimate for Eurozone gross domestic product (GDP) contraction in 2020 is 8%, down from growth of 1.3% at the start of March. US GDP forecasts have fallen a bit less during this time—from 1.8% to -5.7%.

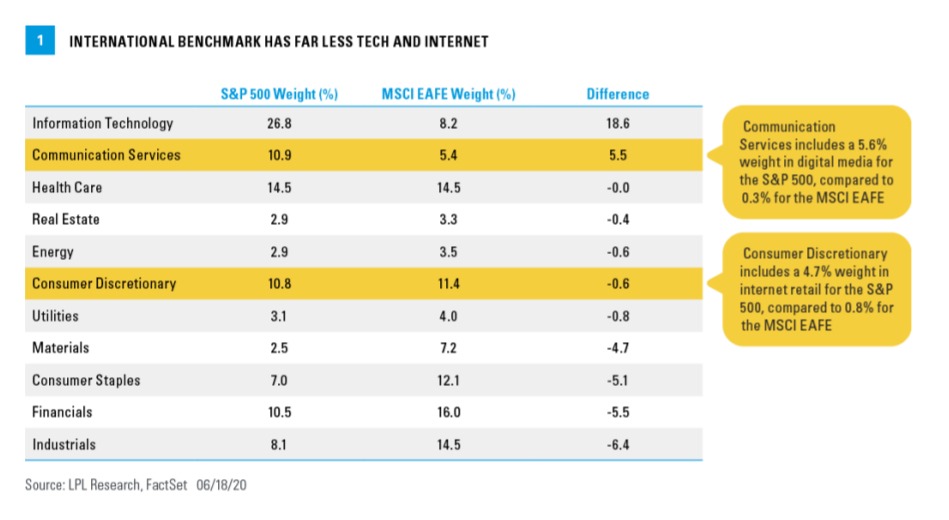

2) International markets are more value-oriented. Until more signs of a durable economic recovery emerge globally, we are skeptical that value stocks can sustain a relative performance advantage over growth. The MSCI EAFE Index for non-US developed market equities has only 8% in the technology sector, compared with 26% in the S&P 500 [Figure 1]. Internet retail and digital media exposures—well positioned for the pandemic—are also much lower in the MSCI EAFE Index and create a relative performance headwind when these groups lead, as they have recently.

3) Performance continues to disappoint. International equities have been unable to sustain relative outperformance compared with the United States for much of the past 10 years. Until the MSCI EAFE Index can sustain strength for more than just a month here or there, we are likely to remain cautious.

4) Valuations are not good short-term timing tools. International stocks have not received much help from low valuations in recent years. Valuations generally don’t tell us much about the next year or two, so we would need more reasons to re-allocate from US equities to international. That said, lower valuations have correlated well with long-term returns historically, suggesting strategic investors who are in it for the long haul may benefit from these allocations.

5) Structural concerns. Post-crisis, deficits, and populism may continue to weigh on investor sentiment, consumer spending, and capital investment for the Eurozone. We are encouraged by the recent movement toward a coordinated fiscal response to COVID-19, but once this fire is put out, more coordination will be needed to drive better returns across Europe.

POSSIBLE UPSIDE CATALYSTS

We see several potential paths for upside to international developed equities:

1) Coordinated global growth recovery. Once the virus is well contained, we may see global equity market correlations increase and the rising tide lift all boats. Europe is a big exporter to China—though there are tensions there, too—and the United States would benefit from a strong global recovery. In this scenario, we would expect value stocks to keep pace with or possibly outpace growth stocks, which would help international equities.

2) Japan could surprise. Bloomberg’s consensus forecast for Japan’s GDP contraction in 2020 is -4.9%, less of a decline than in Europe or the United States, and supported by a very aggressive stimulus response. In fact, the latest policy proposal could bring Japan’s fiscal policy boost to 40% of its GDP, more than double what the United States will likely end up with, even after the next potential package. Japan has also done a good job containing the virus in general.

3) Further US dollar weakness. We expect the trade and budget deficits in the United States to put downward pressure on the US dollar, which may prop up international investment returns. The Bloomberg US Dollar Index has slid 6% since the S&P 500 bottomed on March 23 and the safe-haven trade began to reverse.

EMERGING MARKETS APPEAR BETTER POSITIONED

China has led the way out of the global crisis in terms of containing the virus and reopening its economy, which in theory would position emerging market (EM) equites for strong performance. But that has not been the case so far as emerging market stocks, represented by the MSCI EM Index, have underperformed the S&P 500 in 2020 by 7 percentage points after lagging significantly over the past decade. We still like the potential for EM based on a stronger economic growth outlook, a smaller expected earnings decline, and, as with developed international, the potential for a weaker dollar, but we understand investor skepticism and would suggest keeping EM allocations relatively modest.

We favor Asia over Latin America due to a stronger growth outlook, more attractive sector positioning, and less dependence on commodity exports. We also recommend active EM investing over passive to enhance opportunities to find companies with strong corporate governance practices and capitalize on dispersion across the asset class.

Our primary concerns besides the relative performance struggles in recent years are: 1) increasing US China tensions, 2) emerging market’s difficulty converting economic growth into profits and shareholder value, 3) political instability in several countries, and 4) Brazil’s inability to contain COVID-19.

CONCLUSION

We find the opportunities in the US market more attractive than developed international when we look out over the next 12 to 18 months. To get more interested in shifting equities from the United States to developed international markets, we would like to see improved relative performance, more evidence of a durable global economic recovery, and increased investor demand for value stocks. For investors looking for more international diversification, we would suggest EM or possibly Japan. For long-term investors, we remain comfortable with meaningful allocations to developed international equities.

Click here to download a PDF of this report.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

Investing in foreign and emerging markets securities involves special additional risks. These risks include, but are not limited to, currency risk, geopolitical risk, and risk associated with varying accounting standards. Investing in emerging markets may accentuate these risks.

U.S. Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI EAFE Index: The Morgan Stanley Capital International Europe, Australia, Far East (MSCI EAFE) Index is a capitalization-weighted index that tracks the total return of common stocks in 21 developed-market countries within Europe, Australia and the Far East.

All index data from FactSet.

Please read the full Outlook 2020: Bringing Markets into Focus publication for additional description and disclosure.

This research material has been prepared by LPL Financial LLC

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value

Tracking # 1-05024406 (Exp. 06/21)

Recent Posts

The Intersection of Political Uncertainty and Global Debt Markets | Weekly Market Commentary | September 15, 2025

Stocks Are Following the Market’s Playbook | Weekly Market Commentary | September 8, 2025

Calm Before the Storm: Can This Rally Continue in September? | Weekly Market Commentary | September 2, 2025

Grand Ideas at the Grand Tetons | Weekly Market Commentary | August 25, 2025

Earnings Season Delivered | Weekly Market Commentary | August 18, 2025

Stocks Sailing Smoothly Through Policy Crosscurrents So Far | Weekly Market Commentary | August 11, 2025

Seven Takeaways From a Dizzying Week For Markets | Weekly Market Commentary | August 4, 2025

Categories