Lower Valuations May Signal Solid Gains For Stocks

Stocks have rebounded strongly off the December lows, with the S&P 500 Index adding 2% in January to its 7% gain over the last week of 2018. We see potential for further gains ahead given the fundamentals supporting economic growth and corporate profits, along with a Federal Reserve that appears more flexible than previously feared, and improving prospects for a U.S.-China trade deal.

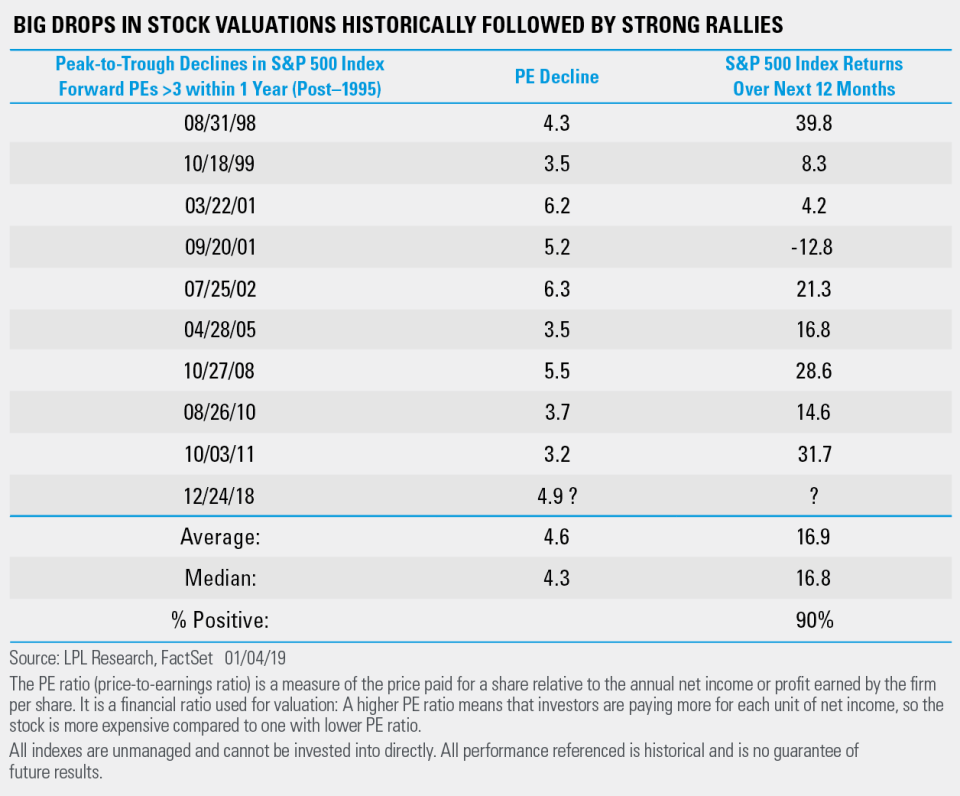

Not only do we believe stocks should garner support from strong fundamentals, but we also believe the stock market is pricing in too much pessimism relative to the outlook for corporate profits. The price-to-earnings ratio (PE) for the S&P 500 Index fell nearly 5 points last year (from roughly 19 to 14), one of the biggest drops in decades. PE is a measure of how much market participants are willing to pay for companies’ future earnings.

To determine what this might mean for stocks going forward, we identified periods with the biggest drops in PE (3 points or more) and analyzed stock market performance from those points forward. We found that after their PE declines, the S&P 500 produced an average return of 17% over the next year, as shown in the LPL Chart of the Day.

The only time stocks declined over the ensuing 12 months was in 2001, during the bear market of 2000–2002. The current environment looks much better to us than that period. John Lynch, LPL Chief Investment Strategist, noted that, “Investors may be getting a bear market discount for better-than-bear-market earnings, thanks to the sharp drop in stock valuations. Narrowing PE multiples of this magnitude may set stocks up for solid gains in the months ahead, bolstered by continued— albeit slower—growth in corporate profits.”

Bottom line, stocks appeared to be on the discount rack during the holidays, and that discount may have increased the likelihood of above-average returns in 2019. For more of our thoughts on what lower valuations may mean for stocks in the coming months, please see this week’s Weekly Market Commentary.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. The economic forecasts set forth in this material may not develop as predicted.

All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. All performance referenced is historical and is no guarantee of future results.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

The investment products sold through LPL Financial are not insured deposits and are not FDIC/NCUA insured. These products are not Bank/Credit Union obligations and are not endorsed, recommended or guaranteed by any Bank/Credit Union or any government agency. The value of the investment may fluctuate, the return on the investment is not guaranteed, and loss of principal is possible.

Recent Posts

Why Tax Planning Is a Year-Round Strategy, Not a March Panic

Financial Planning Resolutions for 2026

Essential Estate Planning Steps Every Family Should Take

2026 Outlook: The Policy Engine

Why Long-Term Care Planning Matters

Women & Wealth: Financial Planning Strategies for a Lifetime

How Emotions Affect Financial Decisions

Categories