The Diversified Investor’s Big January

Diversified investors just capped one of their best months of the current economic cycle.

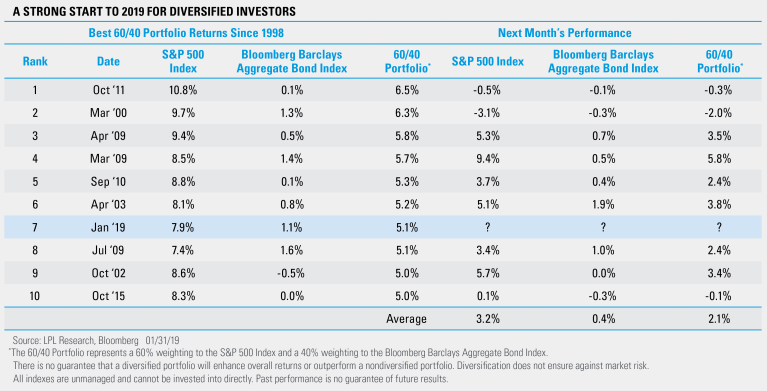

In January, the S&P 500 Index posted its biggest monthly gain since October 2015. At the same time, the Bloomberg Barclays Aggregate Bond Index (Agg), which represents high-quality bonds, rose 1.1%, its second-best monthly performance in 2.5 years. As shown in the LPL Chart of the Day, U.S. stocks and bonds’ strong rallies led to the best month for diversified investors since October 2011.

Since 1998, the 10 best months for diversified portfolios— or a hypothetical portfolio with 60% in stocks and 40% in bonds–have typically preceded more positive returns for both assets in the following month. On average, the S&P 500 rose 3.2% after these months, while the Agg increased 0.4%.

RECOMMENDED READ: Outlook 2019

“A rising tide lifted all boats last month as financial markets recovered from a rocky end to 2018,” said LPL Research Chief Investment Strategist John Lynch. “Still, we stress the importance of owning high-quality bonds for diversified portfolios, interest income, and liquidity.”

Fixed income may be especially important as a portfolio hedge in the upcoming year. As mentioned in our Outlook 2019, we expect the S&P 500 to climb this year, but we could see higher volatility as investors digest global headwinds and tightening financial conditions amid solid economic fundamentals and corporate profit growth. Bonds have outperformed stocks in all 14 S&P 500 corrections since 2008, including the most recent slide: The Agg rose 1.6% during the S&P 500’s 19.8% drop from September to December 2018.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. The economic forecasts set forth in this material may not develop as predicted.

All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. All performance referenced is historical and is no guarantee of future results.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal and potential illiquidity of the investment in a falling market.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

Credit Quality is one of the principal criteria for judging the investment quality of a bond or bond mutual fund. As the term implies, credit quality informs investors of a bond or bond portfolio’s credit worthiness, or risk of default. Credit ratings are published rankings based on detailed financial analyses by a credit bureau specifically as it relates the bond issue’s ability to meet debt obligations. The highest rating is AAA, and the lowest is D. Securities with credit ratings of BBB and above are considered investment grade.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

The investment products sold through LPL Financial are not insured deposits and are not FDIC/NCUA insured. These products are not Bank/Credit Union obligations and are not endorsed, recommended or guaranteed by any Bank/Credit Union or any government agency. The value of the investment may fluctuate, the return on the investment is not guaranteed, and loss of principal is possible.

Recent Posts

Why Tax Planning Is a Year-Round Strategy, Not a March Panic

Financial Planning Resolutions for 2026

Essential Estate Planning Steps Every Family Should Take

2026 Outlook: The Policy Engine

Why Long-Term Care Planning Matters

Women & Wealth: Financial Planning Strategies for a Lifetime

How Emotions Affect Financial Decisions

Categories